am i taxed on stock dividends

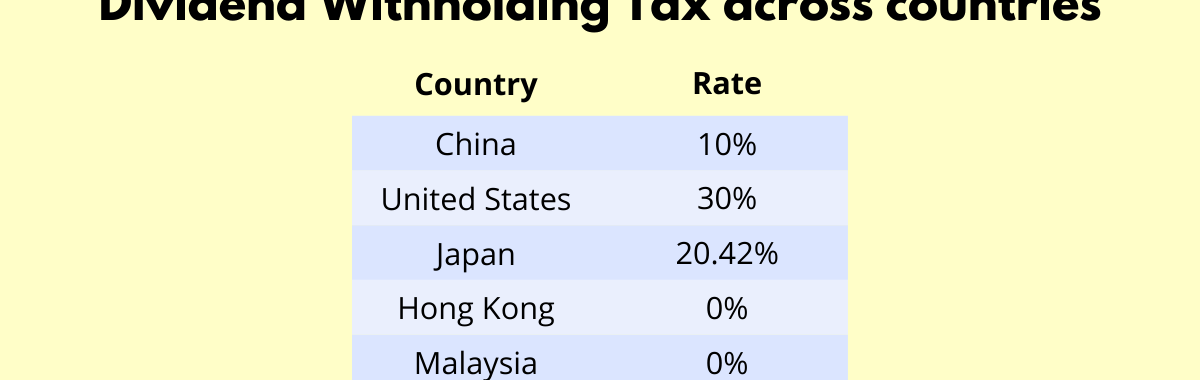

Stock as a Canadian resident there will be 15 withholding tax on any dividends earned. There are several things to keep in mind when considering Section 199A dividends.

/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

Form 1099 Div Dividends And Distributions Definition

Its entirely up to you.

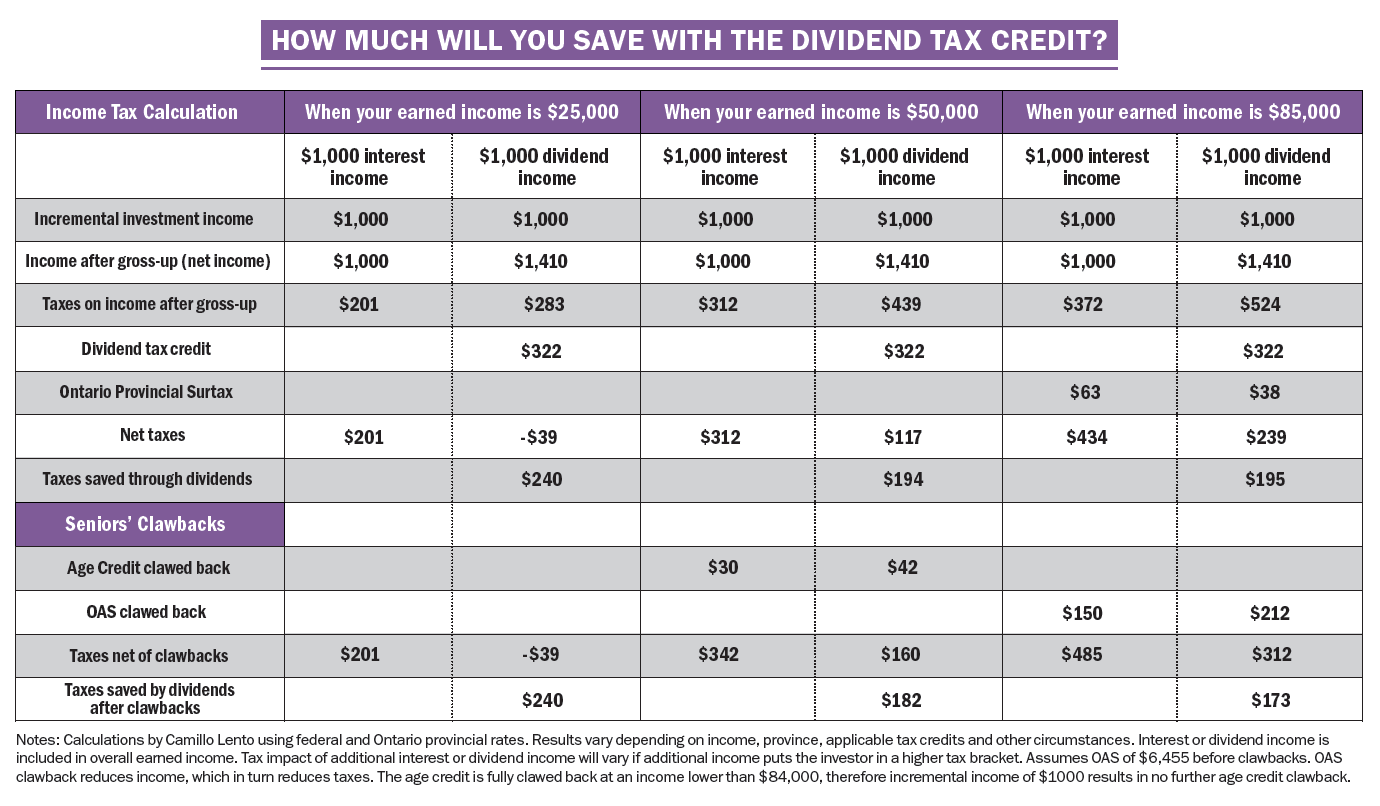

. TSX price on that day. On the other hand you may want to issue dividends annually at the end of each tax year or sporadically throughout the year when your company profits reach a certain level. Reinvesting the dividends that you earn from your investments is an excellent way to grow your portfolio without dipping into your wallet.

While mutual funds have made dividend reinvestment easy. The treaty requires 15 tax withholding on dividends and 10 tax withholding on interest. Here is an example of how the tax deduction works for Section 199A dividends.

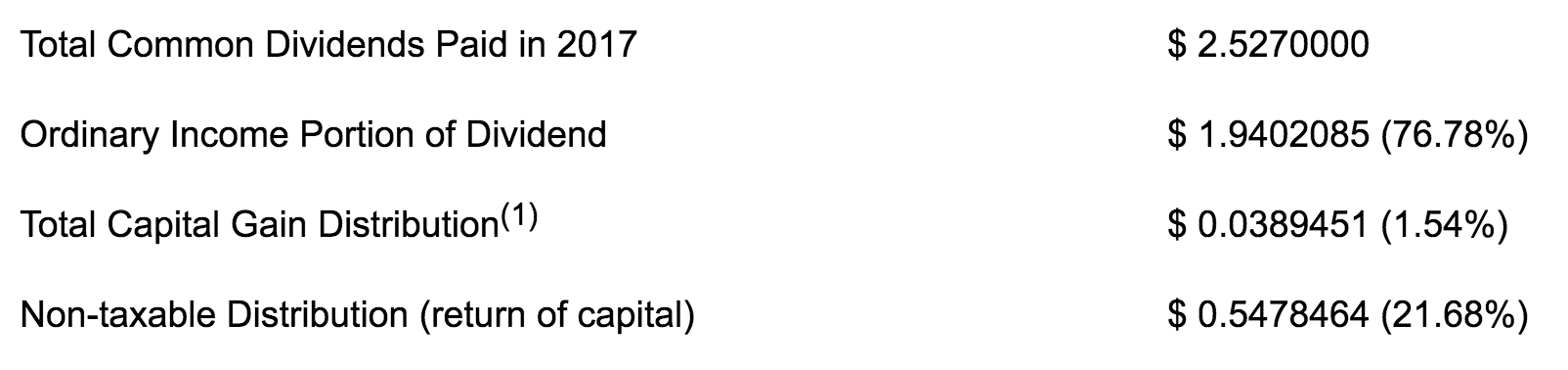

Beginning with our taxable year ended December 31 2017 we believe that we have operated in a manner qualifying us as a real estate investment trust REIT and we have elected to be taxed as a REIT for federal income tax purposes. Is a Maryland corporation formed on September 28 2015. Dividends and capital gains.

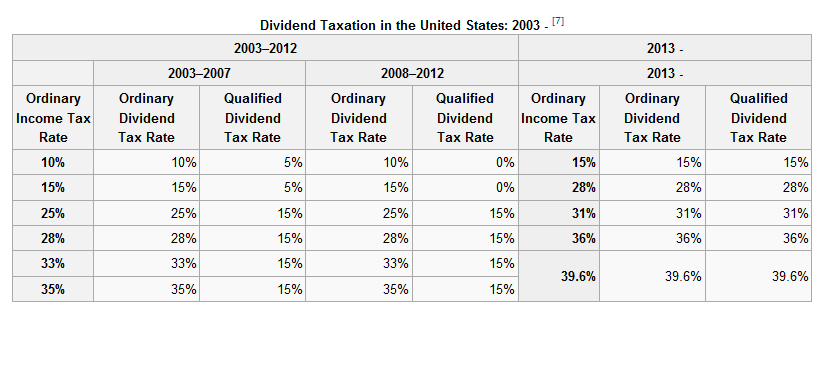

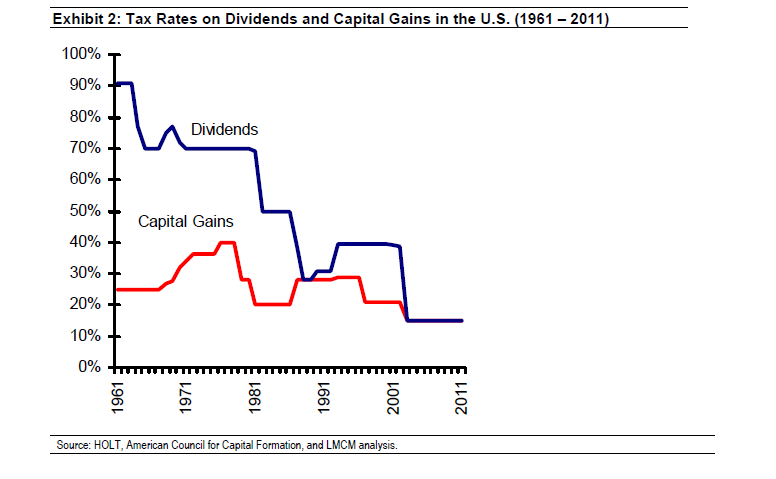

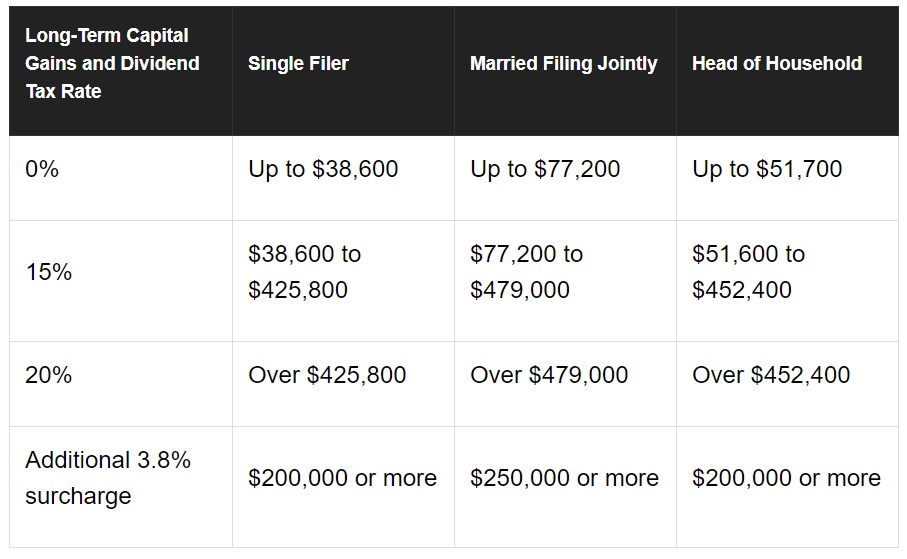

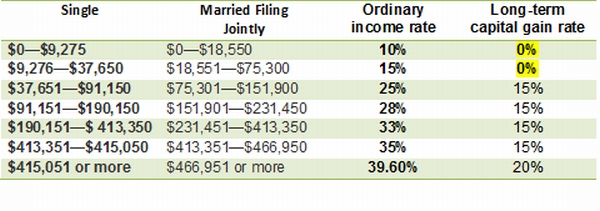

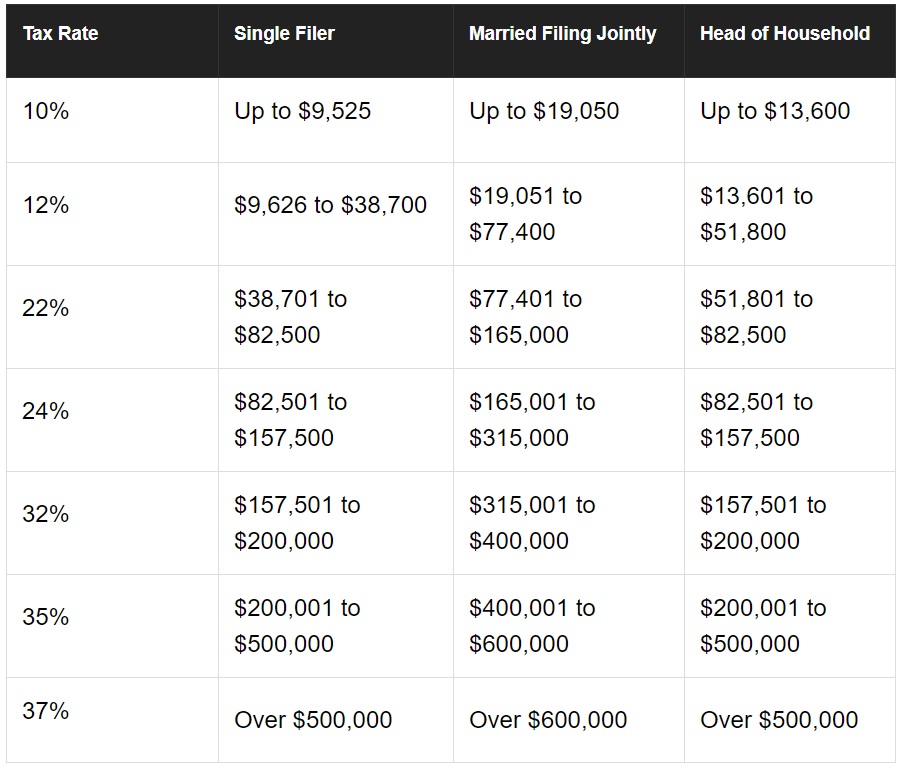

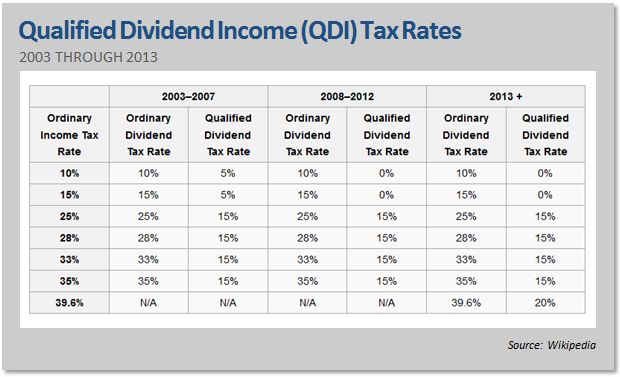

Investors often prefer them over dividends which are treated as ordinary income and taxed at up to 37. Transfer shares in your limited company today - for only 6999. Dividends provide an excellent opportunity for effective tax planning.

Jun 29 2022 - 120620 AM. Since Box 1a reports all of. TSX price on that day.

Section 199A dividends are a slice of the pie of dividends. The full pie of dividends total ordinary dividends is reported in Box 1a of Form 1099-DIV. Dividends are paid out of the profits of the company if any.

Mutual funds offer investors returns in two forms. There have been two stock splits in our history. So if you own a US.

What past stock splits have affected TC Energy Corporation or previously TransCanada Corporation or TransCanada Pipelines Limited shares. Know how different mutual funds are taxed in a different manner depending on the type of mutual fund the investment holding period. Medalist Diversified REIT Inc.

If buybacks boost a stocks value investors who hold the shares long enough pay a lower.

Selling Shares Beats Collecting Dividends Physician On Fire

Ultimate Guide To Dividend Tax 2021

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Do You Pay Taxes On Investments White Coat Investor

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

How Dividend Reinvestments Are Taxed

How To Pay No Tax On Your Dividend Income Retire By 40

How Dividend Reinvestments Are Taxed

U S Dividend Withholding Tax What Singapore Investors Must Know

How The Dividend Tax Credit Works

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

The Power Of 50 000 In Dividend Income Explained

The 60 Day Qualified Dividend Rule White Coat Investor

/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)